Modernising the underwriters' experience - Why now?

- Posted on April 6, 2023

- Estimated reading time 5 minutes

The expectations of an underwriter have significantly transformed over the past decade, with black swan events such as COVID-19, rapid technological advances, changing customer expectations and more complex risks (i.e., geo-politics, climate change and natural disasters), all contributing to dramatic shifts in what success looks like for an underwriter and their ability to deliver profitable loss ratios.

Now more than ever, underwriters are under significant pressure to perform accurate risk assessments, make profitable decisions, and win new business; all whilst under extreme strain to deliver efficiently to their clients (broker, MGA or direct). However, underwriting across many lines of business is often complex, taking time to analyse and follow underwriting policies, philosophies, and processes, which typically involve multiple levels of hierarchy to assess and approve the risks associated.

To support the underwriting process, carriers have historically configured into policy administration systems (PAS) or integrated an underwriting workbench within the PAS. One of the challenges this presents is that a PAS solution predominantly focuses on post-bind activities, rather than pre-bind.

With an increasingly competitive landscape within the industry, time from submission to quote/bind is a key metric that carriers benchmark against to measure responsiveness, competitiveness, and win new business to remain relevant within their field.

How can carriers achieve this and empower their underwriters?

The answer lies in empowering underwriters with a Modern Underwriter Workbench & Platform.

What is an underwriter workbench and why is it needed?

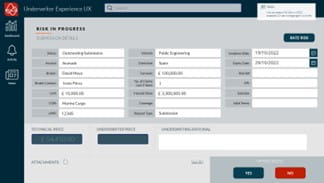

An Underwriters Workbench (UW) can be defined as a single pane of glass, providing the underwriter with a centralised view to facilitate the process from submission to quote/bind. A UW can also be used to empower collaboration within the organisation, transforming the way teams work together to support their internal processes. The UW becomes powerful when the workbench connects into disparate data sources, providing underwriters with the information to make decisions quickly and effectively, rather than switching between several systems and data sets.

Today, carriers are looking to overcome several challenges which prevent the underwriter from performing efficiently:

- Data Fragmentation: Multiple disparate data sets across several core business applications limit analysis across the decision-making process

- Workflow Visibility: Tasks for the underwriter and teams aren’t consolidated, leading to sinking time into non-value-add tasks and a lack of audit trails for reporting

- Pace of innovation: Inflexible platforms provide various restrictions on the underwriter process, which are difficult to overcome due to complexity and nature of systems.

Objectives of implementing a modern underwriter workbench

Carriers must prioritise insight-driven underwriting to remain relevant in the market, and provide timely, risk-appropriate policies to customers. Typically, the common objective of implementing a modern underwriter workbench align to the following key areas:

- Creating Operational Efficiencies: Reducing time from submission to quote/bind; clarity on process and actionable insight; automating processes

- Data Led Decisions: Improving risk assessment capabilities from pulling together disparate data sets, analytics of performance and identifying internal pain points

- Improving the underwriter’s productivity: Supporting underwriters to focus on value-added tasks

How can Avanade assist?

The Avanade UW Accelerator is a pre-built foundational Submission & Quote Management solution, leveraging the Microsoft Power Platform technology which was designed & developed by Insurance CTO’s. It provides a single pane of glass for the Underwriter, providing greater visibility of workload, allowing them to manage their pipeline more efficiently, with the aim of reducing errors through automation, increasing transparency, and subsequently, reducing the time from Submission to quote/bind.

The Avanade solution contains a pre-built data model, supporting User Interfaces and workflow capability. This supports a rapidly deployable base solution into your business, which can be built upon to reflect your specific requirements and business processes.

Data powers every decision

Our accelerator leverages the Microsoft Dataverse, which is a cloud-based data storage and management platform offered as part of the Power Platform. Benefits include:

- Easy Integration: Dataverse seamlessly integrates with Microsoft applications such as Power BI, Dynamics365 and other M365 apps, as well as with third-party applications. This makes it easy to integrate data from various sources to support the single pane of glass view

- Customisation: Dataverse provides a flexible data model that allows businesses to customise their data schema quickly and easily, to fit their specific needs. It also provides a range of tools to create custom workflows, forms, and business rules to automate business processes

- Collaboration: Dataverse allows multiple users to work on the same data set simultaneously, which promotes collaboration and teamwork. Users can share data sets, views, and dashboards with other users in the organisation, or create their own. Seamless integration to other M365 apps such as Outlook and Teams further enhances collaboration opportunities.

Microsoft Dataverse provides a secure, flexible, and scalable platform for businesses to manage and store their data, which can help them streamline their operations and make data-driven decisions.

Choose a platform, not just a tool…

The underwriter workbench is only one component of the process for underwriters and carriers. What must be considered is taking a platform-based approach, rather than a specific tool to meet a use case.

Taking a platform-based approach lends itself to an integrated ecosystem, with standard skillsets and integration that can push boundaries way beyond a specific underwriter workbench. For example, the Avanade UW Accelerator leverages the Power Platform as the core, which can seamlessly integrate with other Microsoft services (as per below), such as Dynamics365, M365, PowerBI and Azure to enhance functionality and wider use cases across the business, without the need for a multi-supplier/complex APIs and dependencies.

Please reach out to me via email if you would like to discuss your underwriter transformation, and for a demo of the Avanade UW Accelerator built on Microsoft native tooling.

Thanks for subscribing. Watch your inbox for blog alerts and updates.

Thanks for subscribing. Watch your inbox for blog alerts and updates.

Comments